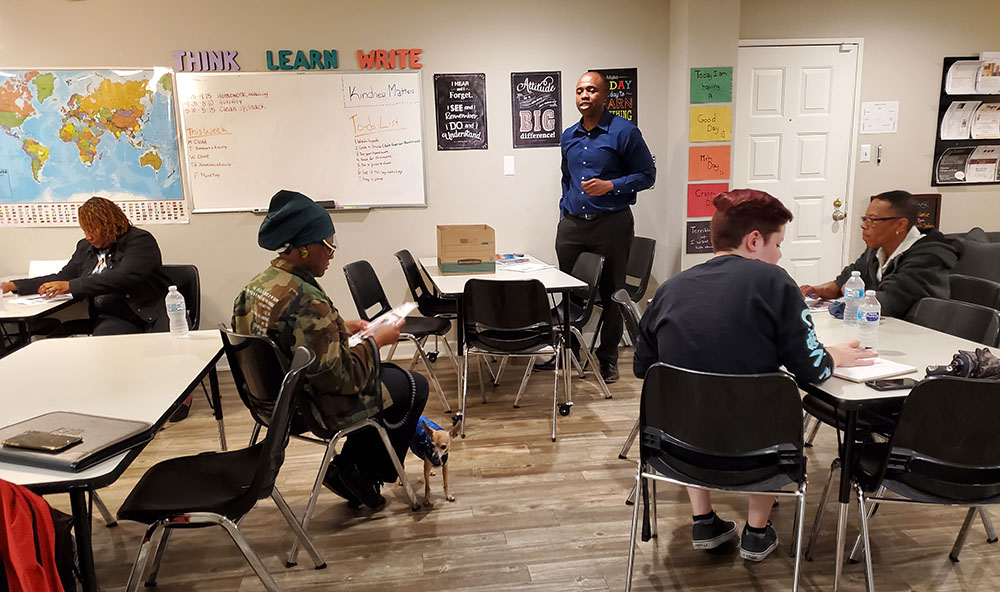

Residents attended a workshop on how to manage debt. Photo taken before the COVID-19 pandemic.

April is considered Financial Literacy Month. You might think what does financial literacy have to do with Project Access? One of the primary key drivers for us is our desire to help our Residents achieve economic stability. This can only be achieved if they are fluent in understanding and practicing financial literacy.

During the pandemic and corresponding economic downturn, you may have heard the phrase “financial literacy”, but have you ever wondered exactly what that means? In its purest definition, financial literacy is the ability to understand and effectively use various financial skills, including personal financial management, budgeting, and investing. The lack of these skills is called financial illiteracy.

The goal of our financial literacy efforts is to assist Residents to attain or retain employment, improve their knowledge on saving money, and address the digital divide by increasing access to technology. We do this through education, employment assistance, computer lab access, technology training, second language acquisition, plus GED and vocational training preparation.

The attainment of financial literacy is critical in these tough economic times. When so many families are economically impacted, a thorough understanding of financial basics is key to ensuring a brighter and more secure future. We’re grateful to the following financial institutions for helping us assist our Residents to become financial knowledgeable:

- Pacific Premier

- Banc of California

- Union Bank

- First Republic Bank

- Bank of America